Sell My Winkler County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Winkler County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

Winkler County Mineral Rights: Owning and Selling Minerals in Winkler County, Texas

Introduction

Welcome to the heart of Texas's vibrant mineral rights landscape - Winkler County. Renowned for its rich natural resources, this county has become a focal point for mineral rights owners. In this comprehensive guide, we delve into the compelling reasons why selling your mineral rights in Winkler County could be one of the smartest financial decisions you make. We will explore the county's rich history, the specifics of owning mineral rights here, and the numerous benefits that come with selling them. Whether you're a long-time owner or new to the scene, this page promises valuable insights into making the most of your valuable assets.

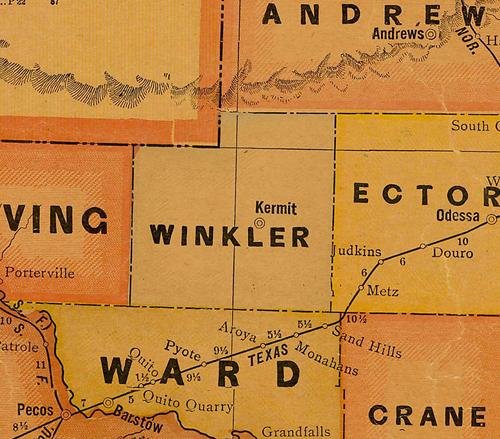

The Rich History of Winkler County

Winkler County's story is deeply intertwined with the American tale of exploration and prosperity. Established in 1887, this county, named after Confederate Colonel Clinton M. Winkler, has a rich tapestry of historical milestones.

Early Days: Originally, Winkler County was sparsely populated, known more for its vast prairies than its mineral wealth. It wasn't until the early 20th century that the county's true potential began to unfold.

Oil Boom: The discovery of oil in the neighboring Ector County during the 1920s marked a turning point. This led to increased exploration in Winkler County, culminating in its own oil discovery in 1926. The subsequent oil boom transformed the region, attracting entrepreneurs and fortune-seekers.

Mineral Rights and Landowners: The flourishing oil industry brought a new focus on mineral rights. Landowners found themselves in possession of highly sought-after assets, leading to a new era of prosperity and challenges.

This rich history has shaped Winkler County into a hub for mineral rights activity, laying a foundation that continues to impact owners today.

Understanding Mineral Rights in Winkler County

Mineral rights in Winkler County are more than just a piece of land; they're a gateway to potential wealth. Here's what sets them apart:

Definition and Value: Owning mineral rights means you hold the keys to the natural resources below the surface. In Winkler County, this primarily includes oil and gas, commodities with significant market value.

Unique Landscape: The geological makeup of Winkler County makes it a prime location for oil and gas extraction. This uniqueness adds to the value of mineral rights in the area.

Market Overview: The current market for mineral rights in Winkler County is dynamic. With technological advancements in extraction methods and fluctuating global oil prices, the value of these rights can be substantial.

Understanding these aspects is crucial for mineral rights owners, as it informs their decisions regarding the management and potential sale of these assets.

Why Selling Your Mineral Rights Can Be a Wise Financial Move

Deciding to sell your mineral rights in Winkler County isn't just about relinquishing a piece of property; it's a strategic financial move with several compelling benefits:

Immediate Financial Gain: The most apparent advantage is the immediate lump sum payment. This capital injection can significantly bolster your financial standing, allowing for investments in other ventures or securing your financial future.

Risk Mitigation: The value of mineral rights is subject to market fluctuations and the inherent uncertainties of extraction operations. Selling your rights transfers these risks to the buyer, providing you with financial stability regardless of market conditions.

Tax Advantages: Capital gains from selling mineral rights can be more favorably taxed compared to income from leasing or royalties. This can lead to substantial tax savings, enhancing the overall financial benefit.

Eliminating Management Hassles: Owning mineral rights often comes with administrative burdens and the need for constant market vigilance. Selling frees you from these responsibilities, allowing you to focus on other areas of your life or business.

Key Financial Benefits:

Receive a substantial upfront payment.

Protect yourself from market volatility and operational risks.

Potential for favorable tax treatment on the sale.

Freedom from the complexities of managing mineral rights.

Considering these factors, selling your mineral rights in Winkler County can be a shrewd and lucrative decision, especially in a market ripe with opportunities.

Navigating the Process of Selling Your Mineral Rights

The process of selling mineral rights, while straightforward, requires informed decision-making and careful consideration. It typically involves:

Valuation: Determining the worth of your mineral rights based on current market trends and potential reserves.

Market Analysis: Understanding the demand for mineral rights in Winkler County.

Legal and Financial Consultation: Ensuring compliance with legal standards and optimizing financial outcomes.

Finding a Buyer: Engaging with potential buyers and negotiating terms.

Seeking expert advice is crucial in navigating these steps effectively to secure the best possible deal.

Conclusion

Embrace the financial opportunities awaiting in Winkler County by considering the sale of your mineral rights. With immediate financial gains, reduced risks, and potential tax benefits, it's a decision worth exploring. Contact our experts today to start your journey towards a more secure financial future.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329