Sell My Upton County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Upton County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

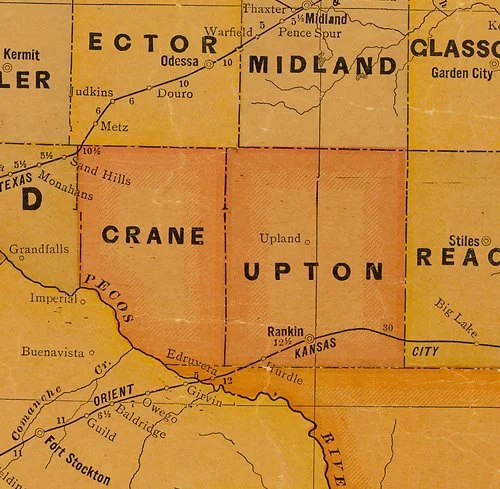

Upton County Mineral Rights: Owning and Selling Minerals in Upton County, Texas

Introduction

Upton County, Texas, a name synonymous with opportunity for mineral rights owners, beckons with its rich subterranean assets. This page aims to guide you through the potentially lucrative journey of selling your mineral rights in Upton County. With a history steeped in the discovery and exploitation of oil and minerals, Upton County stands as a beacon for those looking to capitalize on their underground assets. Let's explore the unique aspects of Upton County and why selling your mineral rights here could be a wise financial decision.

Upton County: Historical Background

Established in 1887 and named after two brothers who fought at the Alamo, Upton County has a storied past. Initially dominated by ranching and farming, the county's destiny shifted with the discovery of oil in the 1920s. This discovery placed Upton County squarely on the map as a significant player in the oil industry. Today, it is part of the Permian Basin, one of the most prolific oil-producing regions in the world, with a rich endowment of mineral resources that continue to attract investors and energy companies alike.

The Significance of Mineral Rights in Upton County

Owning mineral rights in Upton County is more than just a claim to a piece of land; it's a ticket to potential wealth. The county's position within the Permian Basin makes it a hotspot for oil and gas production. Here’s what sets Upton County apart:

Resource Richness: The county is known for its substantial oil and natural gas reserves.

Ongoing Demand: The continuous global demand for energy resources keeps the value of these minerals high.

Steady Royalty Income Potential: Owning mineral rights can lead to regular royalty payments, providing a stable income stream.

Recent market analyses indicate a persistent rise in the value of mineral rights in Upton County, marking it as a promising area for those owning these rights.

Benefits of Selling Mineral Rights in Upton County

Selling your mineral rights in Upton County can offer several financial advantages. Here are some key benefits to consider:

Immediate Financial Rewards: A sale can provide a substantial lump sum payment, offering an immediate financial boost. This influx of cash can be pivotal for investments, debt clearance, or other financial goals.

Tax Benefits: Selling your mineral rights may lead to potential tax advantages, which can be more favorable than the taxes on recurring royalty payments.

Investment Diversification: Liquidating your mineral rights allows you to redistribute your financial portfolio, reducing reliance on the energy sector's volatility.

Favorable Market Conditions: The current market in Upton County is particularly advantageous for sellers, with strong demand driving competitive pricing.

Risk Mitigation: The energy market is subject to fluctuations due to various factors. Selling your rights can eliminate the uncertainties associated with these market changes.

Steps to Selling Mineral Rights in Upton County

The process of selling your mineral rights in Upton County can be straightforward if approached methodically. Here’s how you can navigate the process:

Valuing Your Rights: Begin by understanding the worth of your mineral rights, considering factors like location, existing production, and market trends.

Finding the Right Buyer: Seek a buyer who offers a fair deal. This may involve consulting with brokers or directly engaging with interested companies.

Handling Legal and Financial Matters: Ensure all legalities are in order, from contract negotiations to title verification. Be aware of the tax implications of your sale.

Finalizing the Sale: Once an agreement is reached, the transaction is completed with the transfer of rights in exchange for payment.

Conclusion

Selling your mineral rights in Upton County, Texas, can be a strategic move that unlocks immediate financial benefits, offers tax advantages, and allows for investment diversification. With favorable market conditions and a simplified selling process, now is an opportune time to consider capitalizing on your mineral assets. The decision to sell is significant, requiring careful thought and possibly the advice of experts. Upton County's rich history in mineral wealth could be the key to your financial success and stability.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329