Sell My Tarrant County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Tarrant County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

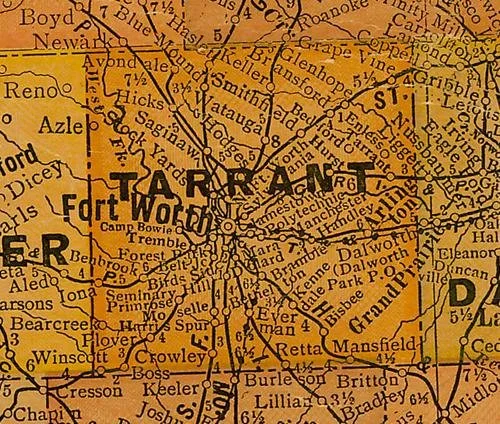

Tarrant County Mineral Rights: Owning and Selling Minerals in Tarrant County, Texas

Introduction

In the heart of Texas lies Tarrant County, a region with a rich tapestry of history and economic development, significantly tied to its abundant mineral resources. For owners of mineral rights in this county, there lies a hidden potential for substantial financial gain. This guide is dedicated to you, the mineral rights owners of Tarrant County, offering insights into why selling your mineral rights could be a strategic and profitable decision. Let's explore the unique aspects of Tarrant County that make it a prime location for mineral rights transactions.

Tarrant County: Historical and Modern Overview

Tarrant County's journey from a frontier settlement to a bustling economic powerhouse is a story of transformation and growth. Named after General Edward H. Tarrant of the Texas Militia, the county was established in 1849 and has since become an integral part of the Dallas-Fort Worth metroplex. The discovery and development of oil and natural gas reserves have played a pivotal role in shaping the county's economy. Today, Tarrant County stands as a testament to the enduring value of its natural resources, particularly in the realm of energy production.

Understanding the Value of Mineral Rights in Tarrant County

Owning mineral rights in Tarrant County is akin to holding a treasure trove beneath your feet. Here's why these rights are so valuable:

Resource-Rich Land: Tarrant County is part of the Barnett Shale, one of the largest onshore natural gas fields in the United States.

Consistent Demand: The continuous demand for oil and natural gas elevates the worth of these resources.

Economic Stability: Mineral rights contribute to a form of investment that can offer more stability and potential for profit compared to other assets.

The current market trends highlight Tarrant County as a notable area for those holding mineral rights, with a promising outlook for valuation and demand.

Advantages of Selling Mineral Rights in Tarrant County

Selling your mineral rights in Tarrant County could be more than just a transaction; it can be a smart financial strategy. Here’s why:

Lump-Sum Payment: Selling provides an opportunity for immediate and substantial financial gain, which can be a game-changer for your financial portfolio.

Favorable Market Conditions: The current market in Tarrant County is conducive to sellers, offering competitive prices for mineral rights.

Mitigating Risks: The energy market is susceptible to fluctuations. Selling your rights secures you from future market uncertainties and regulatory changes.

Navigating the Sale of Mineral Rights

Selling mineral rights in Tarrant County can be a smooth process with the right approach. Here’s a guide:

Valuation: Understanding the true value of your mineral rights is the first step. This involves considering factors like location, production potential, and market trends.

Finding the Right Buyer: It’s crucial to engage with reputable buyers or brokers to ensure a fair deal.

Legal and Financial Aspects: Pay attention to the legalities and tax implications of the sale to ensure a seamless transaction.

The Importance of Expert Guidance

While the prospect of selling mineral rights is appealing, navigating this territory requires careful consideration and expert advice. It's recommended to seek guidance from professionals who specialize in mineral rights transactions. They can provide invaluable assistance in valuation, legal procedures, and ensuring you get the best possible deal. Remember, informed decisions lead to successful transactions.

The Future of Mineral Rights in Tarrant County

The landscape of mineral rights in Tarrant County is ever-evolving. With advancements in extraction technologies and the shifting dynamics of the energy market, the value and potential of mineral rights may continue to change. Keeping abreast of these developments is crucial for mineral rights owners looking to maximize their assets.

Conclusion

Selling mineral rights in Tarrant County offers a unique opportunity for financial growth and stability. With its rich reserves and favorable market conditions, Tarrant County stands out as a wise choice for mineral rights transactions. Whether you're looking to capitalize on current market trends or seeking to diversify your financial portfolio, selling your mineral rights could be a pivotal step towards achieving your financial goals. Embrace the opportunity that lies beneath your feet in Tarrant County and consider the potential benefits of selling your mineral rights today.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329