Sell My Martin County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Martin County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

Martin County Mineral Rights: Why Selling is Beneficial

Introduction

Welcome to a world of untapped financial potential in Martin County, Texas! Here, the hidden wealth isn't just in the sweeping landscapes but also beneath them. As an owner of mineral rights in this resource-rich county, you're positioned at the cusp of a potentially life-changing financial decision.

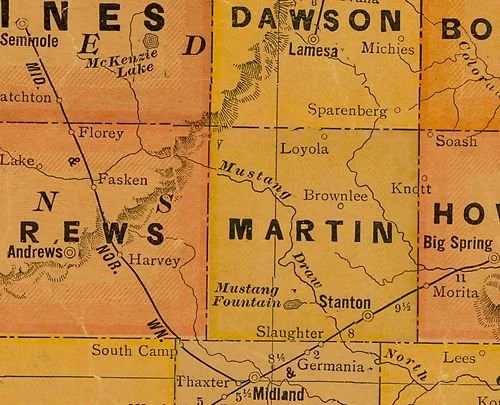

History of Martin County: A Legacy of Prosperity

Martin County's evolution from a humble agricultural community to a powerhouse in the energy sector is a story of transformation and opportunity. The discovery and subsequent boom of oil and natural gas in the area didn't just change the local economy; it created a legacy of wealth generation that continues to this day. This historical backdrop sets the stage for why your mineral rights are more than just land—they're a part of a prosperous legacy.

Unveiling the Value: Why Your Minerals Matter

In Martin County, your mineral rights are not just another asset; they are a golden ticket in today's energy-driven economy. With a high concentration of oil and natural gas, these minerals are not only abundant but also of exceptional quality. This positions them as highly coveted assets in a global market where energy demands are ever-increasing.

The Financial Windfall: Making the Smart Move

Immediate Financial Gain: Selling your mineral rights can translate into substantial immediate cash flow. This liquidity can be pivotal in paying off debts, funding education, or investing in new opportunities.

Market Timing: The energy market is often volatile. By selling now, you capitalize on current high demand and prices, securing your financial gains against future market uncertainties.

Tax Advantages: Navigating the complex world of mineral rights taxes and royalties can be challenging. Selling can simplify your financial landscape, potentially offering tax benefits and easing long-term financial planning.

Risk Mitigation: Holding onto mineral rights comes with risks, including fluctuating market values and operational issues. Selling transfers these risks to the buyer, allowing you peace of mind.

Informed Decisions: Your Path to Financial Security

While the allure of immediate gains is strong, understanding the full value of your mineral rights is key. Consult with industry experts to gain a comprehensive view of your asset's worth. This insight ensures you're not just making a sale, but making the right sale for your financial future.

Conclusion: Seize Your Financial Future

In Martin County, your mineral rights are more than a piece of land; they are a key to unlocking significant financial opportunities. As the energy market continues to evolve, the value and potential of your assets do too. Selling your mineral rights isn't just a transaction—it's a strategic move towards securing your financial legacy. The time to act is now, and the future is yours to seize.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329