Sell My Andrews County Mineral Rights

Locally Owned and Operated Mineral Buyer Since 1994

Sell Your Andrews County Mineral Rights

Receive a Competitive Offer with a Quick Closing Process from a Market-Rate Buyer.

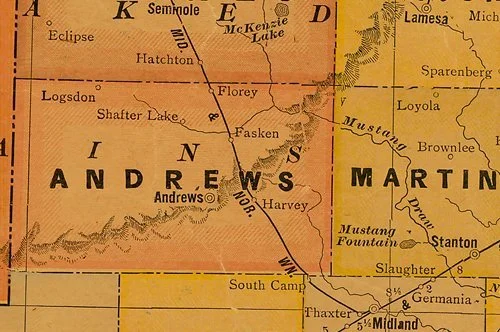

Andrews County Mineral Rights: Owning and Selling Minerals in Andrews County, Texas

Introduction

Nestled in the heart of Texas, Andrews County stands as a beacon in the mineral rights landscape. Known for its rich oil and gas reserves, this county offers a unique opportunity for those holding mineral rights. This guide aims to shed light on the financial advantages of selling your mineral rights in Andrews County. From its historic roots in the oil industry to the current state of the mineral rights market, we will explore why selling these assets can be a strategic move for your financial future.

Andrews County: A Key Player in Texas Oil

Andrews County's history is a testament to its pivotal role in Texas' oil and gas industry.

Historical Significance: The county, named after Richard Andrews, a Texas Revolution hero, has long been synonymous with oil and gas. The discovery of oil in the 1920s marked a turning point, placing Andrews County at the forefront of Texas' oil boom.

Resource Rich: The Permian Basin, which includes parts of Andrews County, is one of the most prolific oil-producing areas in the United States. This has established Andrews County as a critical player in the energy sector.

Continued Development: Despite fluctuations in the oil market, Andrews County has maintained steady growth in the industry, with continued exploration and development of its resources.

This rich history underlines the significance of mineral rights in Andrews County, making them a valuable asset for owners.

Understanding Mineral Rights in Andrews County

Owning mineral rights in Andrews County means holding a key to potential wealth, particularly in the oil and gas sector.

Defining Mineral Rights: In Andrews County, mineral rights pertain to the ownership of natural resources below the ground. These rights are especially lucrative due to the county's abundant oil and gas reserves.

Unique Characteristics: The geological makeup of Andrews County, part of the larger Permian Basin, offers exceptional opportunities for resource extraction. This uniqueness enhances the value of mineral rights here.

Market Overview: The market for mineral rights in Andrews County remains robust, driven by the ongoing demand for oil and gas. This demand, coupled with advancements in extraction technology, keeps the market dynamic and potentially profitable for rights owners.

Understanding these elements is crucial for mineral rights owners in Andrews County, informing their decisions regarding asset management and sale.

The Financial Upside of Selling Mineral Rights in Andrews County

Opting to sell your mineral rights in Andrews County can offer several financial benefits:

Immediate Financial Gain: The most obvious advantage is receiving a substantial upfront payment. This immediate cash flow can significantly enhance your financial position, offering flexibility for other investments or needs.

Risk Management: The value of mineral rights can fluctuate based on market conditions and the unpredictable nature of resource extraction. Selling your rights can mitigate these risks, providing financial certainty.

Tax Advantages: The sale of mineral rights often comes with tax benefits, potentially resulting in significant savings compared to income generated through royalties or leasing.

Ease of Asset Management: Managing mineral rights requires constant attention and expertise. Selling these rights can relieve you of these complexities, allowing you to focus on other areas of your life or portfolio.

Key Financial Benefits:

Substantial lump sum payment.

Protection from market and operational uncertainties.

Potential for tax efficiency.

Freedom from managing mineral rights.

In a market as promising as Andrews County's, selling your mineral rights can be a strategic and lucrative decision.

The Process of Selling Mineral Rights in Andrews County

Selling mineral rights in Andrews County involves a series of important steps:

Valuation: Determining the value of your mineral rights is crucial, taking into account market trends and the potential for resource extraction.

Understanding the Market: Gaining insight into the Andrews County mineral rights market is essential for making informed decisions.

Legal and Financial Consultation: Ensuring compliance with legal requirements and optimizing financial outcomes is key.

Engaging Buyers: Finding potential buyers and negotiating the terms of the sale are crucial final steps.

Expert guidance is invaluable in navigating this process effectively, ensuring you get the best possible deal for your mineral rights.

Conclusion

Explore the financial potential that your mineral rights in Andrews County can unlock. With immediate financial benefits, risk mitigation, and tax advantages, selling these rights is a decision worth considering. Contact our team of experts today to start your journey toward financial growth and security.

"Opportunities multiply as they are seized."

- Sun Tzu, Military Strategist.

FAQs on Selling Mineral Rights

What are the primary benefits of selling oil mineral rights?

The primary benefits include immediate financial gain, risk mitigation, tax advantages, freedom from operational responsibilities, investment diversification, and estate planning simplification.

How does the current market affect the value of oil mineral rights?

The value of oil mineral rights is closely tied to the current market conditions, including oil prices and demand. A strong market can increase their value, whereas a downturn can reduce it.

What are the tax implications of selling oil mineral rights?

Selling oil mineral rights may result in different tax obligations than earning royalties. It's often advantageous to consult a tax professional for specific implications.

How does selling oil mineral rights impact estate planning?

Selling these rights simplifies estate planning by converting a complex asset into liquid capital, making it easier to distribute or reinvest for future generations.

Can selling oil mineral rights offer financial security?

Yes, selling these rights provides immediate financial security by converting an uncertain future income stream into a guaranteed lump-sum payment.

What should be considered before selling oil mineral rights?

Consider factors like current market conditions, future market predictions, personal financial needs, and potential investment opportunities.

How does selling oil mineral rights affect my involvement in oil extraction?

Selling your mineral rights removes any operational responsibilities and involvement in the extraction process, transferring them to the buyer.

Contact

Feel free to contact us with any questions.

Email

ContactUs@RadiantRock.com

Phone

(432) 300-4329